Why Push your PAYDEX Score 80 and Above?

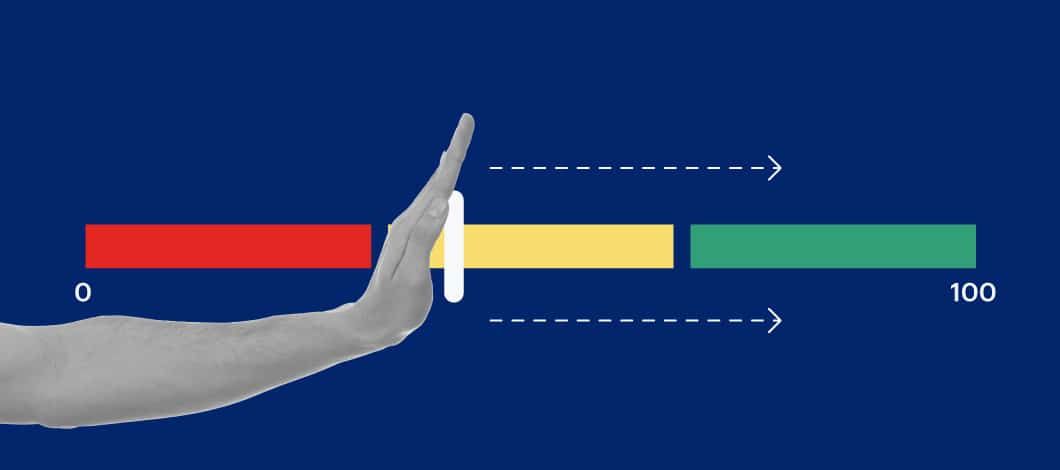

The finance of an enterprise largely depends on the score issued by Dun, and Bradstreet called PAYDEX Score. But What is a PAYDEX Score? And What is the PAYDEX Score Range?

Just like the personal credit score, PAYDEX is a business credit score for your corporation. The PAYDEX Score issues a company with its capability to pay its dues to vendors and suppliers.

Here’s an interpretation of the PAYDEX Score;

100: Pays 30 days earlier than terms

90: Pays 20 days earlier than terms

80: PAYS ON DUE DATE

70: Pays 15 days beyond terms

60: Pays 22 days beyond terms

50: Pays 30 days beyond terms

40: Pays 60 days beyond terms

30: Pays 90 days beyond terms

20: Pays 120 days beyond terms

U/N: Unavailable/no payment

Thus, occurs the notion of the 80 PAYDEX Score and its relevance for a corporation. We will discuss: Why Banks and Investors prefer a company with an 80 and above PAYDEX Score? how to get a PAYDEX score? how to check your PAYDEX score? And How to Increase your PAYDEX Score? Why should you prioritize the PAYDEX Score

Why Banks and investors prefer a company with an 80 and above PAYDEX Score over others?

A company with an 80 PAYDEX Score maximizes the company’s opportunity to receive funding from the shareholders. The 80 PAYDEX Score signifies that the company pays its debts and repayments on the expected date. A finer opportunity awaits if you are able to score better than 80.

PAYDEX Score of 80 or above puts you in a better position for small business lenders, suppliers, and vendors. The Banks and Corporate Bodies prefer a greater PAYDEX Score. It signifies that you that you are a low-risk borrower who clears their dues on time or before the due date.

How to get a PAYDEX Score? How to check your PAYDEX Score?

Duns and Bradstreet issue PAYDEX Score and to get the score for the corporation you need to apply for a D-U-N-S number to establish your business with Duns and Bradstreet so you can become eligible for a score.

At least 4 trade references are required to get a PAYDEX score. Your payments with suppliers and vendors with a payment schedule in place. It confirms your payment due dates and time of the payment to make sure when you complete your payments. That will largely create the base of the Dun and Bradstreet file.

If you want to check your PAYDEX Score, First Purchase a Business Credit Report from D&B. it comes with free alerts that will provide changes in the score. No need to purchase a new report every time you make a payment and unless you changed something on your end.

How to increase your PAYDEX Score?

Now you know what PAYDEX Score is all about. But when you purchase a company or make your own, you need to get the PAYDEX score to reach 80 or above at all costs. That way your company will have a subtle reach to various lenders.

Clear your dues early

PAYDEX score largely depends on the timely due payment of a company. If you clear the dues and complete your debts before the due date, it will create an impact on the rating. It pushes the score on an upward track.

Tradeline Business Accounts

Tradeline business account gives great insight to Dun and Bradstreet about the activity and payment history. It provides data that helps them create a report easily. If one maintains a smooth and zero setbacks on installments, D&B will report the same in the file of the PAYDEX Score, giving a serious jump to the score.

Apply for Small Business Loan

When you pay your trade lines on time, you will soon become eligible for small business loans. Apply for small business loans and pay the dues on time. Make sure you use your business name and wait about 6 months before taking the next step.

Avoid opening too many credit sources

Avoid applying for too many credit cards as excess inquires hamper the PAYDEX Score. Manageable and small efforts will make your business grow swiftly. Too much pressure on the business name will strike hard on the profile.

Check Your PAYDEX Score

It is not a definite step towards growing the score but it is an approach or rather a habit that will help you keep your tables on. When you keep your score in check, you will remain alert for the opportunities that come your way.

Prioritize PAYDEX Score for your company.

PAYDEX is one of the major segments of the business profile of your company, and you need to work hard to gain a good score for the company. Thus, you need to prioritize it over others. Yes, of course, you need to run through the course of managing the company, but to create a portfolio that supports the long-term needs of the company is an important aspect.

Build your PAYDEX score as soon as possible because as a company you will need to get some loans in and what better than a PAYDEX Score of 80 and above. Lenders, vendors, suppliers, and banks look into the aspect of how you pay your dues and clear the debts. If you maintain the streak for a good amount of time, your investment will pay off significantly. D and B continuously gather data and work to improve its system to ensure the greatest accuracy workable. Businesses should provide D&B with a complete financial statement to ensure as accurate a report as possible. When you provide them with data that speaks for itself like clearing the dues on time, it largely impacts the report. Though D&B collects data from 2 previous years as well, the better the transactions you do in the future will also count into the report.

Conclusion

It is important that you establish a good business score for your company in D and B because it will directly put your company in a position that will attract investors and banks. If you want to reach the best in the market, you need to develop on a score above 80 that will show up on the portfolio of your company.

When banks, investors, suppliers, and vendors will look into the reports for D&B, they will surely understand that you are a low-risk borrower making you an asset for them. Aiming for an 80+ score is indeed important, but the road is rough towards it. Thus, take the help of the pointers above and you can reach out to use for better opportunities as well.